Defi — Decentralized Finance, is an ecosystem full of many projects that operates on the blockchain and is aimed at replacing financial institutions.

It is different from centralized finances also known as Cefi, because it eliminates the need for a middle man and asking permission from financial institutions.

No person is needed or involved to approve transactions. Everything that is done in this ecosystem occurs through the use of smart contracts. This means Defi is completely trustless and permissionless which makes it reliable.

For example, you do not have to go to an institution and ask to get a loan, get your credit history analyzed, and then finally wait to get a loan.

The process of taking a loan out occurs within minutes in Defi because of how it has been set up and all other transactions happen quickly instead of waiting days or even weeks.

The point of Defi is to give you control over your finances. More opportunities become available for you to increase your crypto that traditional finance is not capable of having.

Instead of having your money earn a measly 0.2% interest rate in your bank account, you have a wide range of possibilities to multiply your money. These possibilities are staking, liquidity mining, liquidity pools, collateralizing your crypto, flash loans, etc.

Anyone of any age, race, location, gender can take out a loan if you have the right applications. Defi is made to be used by everyone and this financial industry is constantly evolving to become easier and safer to use.

So in Cefi if people put their money in banks, where do people store their money in Defi?

There are 2 types of wallets available, first is the hardware wallet which is a wallet that you physically own and store your cryptocurrency in. Some popular hardware wallets are the Ledger, Trezor, etc.

Then there are digital wallets that are stored online like the Metamask wallet, which is a plugin or also called a web 3 browser extension.

This can easily interact with decentralized applications as the digital wallet is online and simply needs to connect with any applications to be used.

Worried about putting your money into these Dapps?

Well there’s even decentralized insurance which is useful to protect your assets if you have a lot of money distributed in this space. Many normal insurance companies have their flaws such as being susceptible to human error and being hacked.

Decentralized insurance would make the process of filing and tracking a claim very efficient because of smart contracts. Through the use of smart contracts, a new world opens up that is full of possibilities and you can be confident putting your money into this space because you have the ability to protect your assets.

Defi is is designed to provide an open platform that enables various software programs and applications to leverage its infrastructure to enhance their functionalities. Examples of such use cases can be found in protocols like MakerDao and Compound, which serve distinct purposes within the Defi ecosystem.

MakerDao enables borrowing, saving, and shows what Defi has the potential to do.

Compound is a protocol that lets users earn interest rates for supplying their assets.

These are some examples of Dapps or decentralized applications that are built on the Ethereum blockchain. Some other Dapps include games, DEX’s, Decentralized Social Networks, Prediction Markets, and any platforms you see in this network.

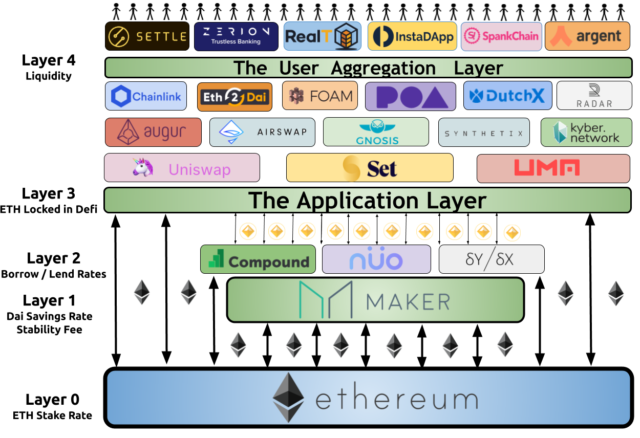

These are some basic building blocks of Defi. With so many projects running on Defi, a good way to visualize this is with Legos.

As you can see, starting from the Ethereum blockchain as Layer 0, there exist multiple layers stacked on top of one another to enhance functionality. Each layer leverages the layer beneath it to add more features.”

Defi serves as a foundation upon which other protocols can be developed to expand its functionality. Financial applications can be considered as building blocks that are added on top of this base plate. One of the key attractions of Defi is the wide range of opportunities it offers for individuals to grow their wealth

As I mentioned earlier, interest rates in a savings account are very low and Defi is the solution for this. There are various lending platforms that offer yield farming, which locks crypto into a smart contract and lets you earn rewards on it.

Staking uses Proof of Stake, which is an algorithm that dictates how blocks are added to the blockchain and lets users validate nodes with their crypto. I won’t be going in-depth about these protocols here, that is another topic on its own. These protocols are made on the Ethereum blockchain.

Also, Dex’s which are decentralized exchanges, are constantly growing. This is where cryptocurrencies can be exchanged directly by the user without needing approval or permission from anyone.

Stablecoins are big in Defi. Basically, they are nonvolatile coins and are pegged to a fiat currency which is volatile. Bitcoin is unpredictable and stablecoins are here as a reliable form of crypto to protect your funds. Stablecoins is essential in Defi because it’s used for staking, yield farming, lending, etc. There are many different kinds of stablecoins and it is useful for daily transactions.

This sounds all good, but there are some risks to Defi as it’s still fairly new. Be careful in what projects you decide to back since many projects are just rug pulls and you could be scammed. Research all the projects you put money into because there have been many incidents of projects being Ponzi schemes where people, unfortunately, lost their money.

To wrap up, Defi may seem very complex. However, at its core, Defi is a platform to bring new decentralized financial opportunities that are not possible in regular finance.